The Entertainment Industry in 2026: A Snapshot of a Business Reset

The entertainment industry in 2026 is not collapsing—but it is clearly resetting.

After years of expansion fueled by streaming competition, easy capital, and volume-driven growth, the entertainment industry in 2026 is now operating under tighter financial discipline. Budgets are shrinking, output is slowing, and efficiency has become just as important as creativity. What follows is a snapshot of where the industry stands today, not a permanent forecast of where it will land.

The entertainment industry in 2026 isn’t collapsing — it’s reassessing how it spends money, manages scale, and defines success.

This is the business taking a hard look at itself.

Why $150 Million Film Budgets Are Finally Being Questioned

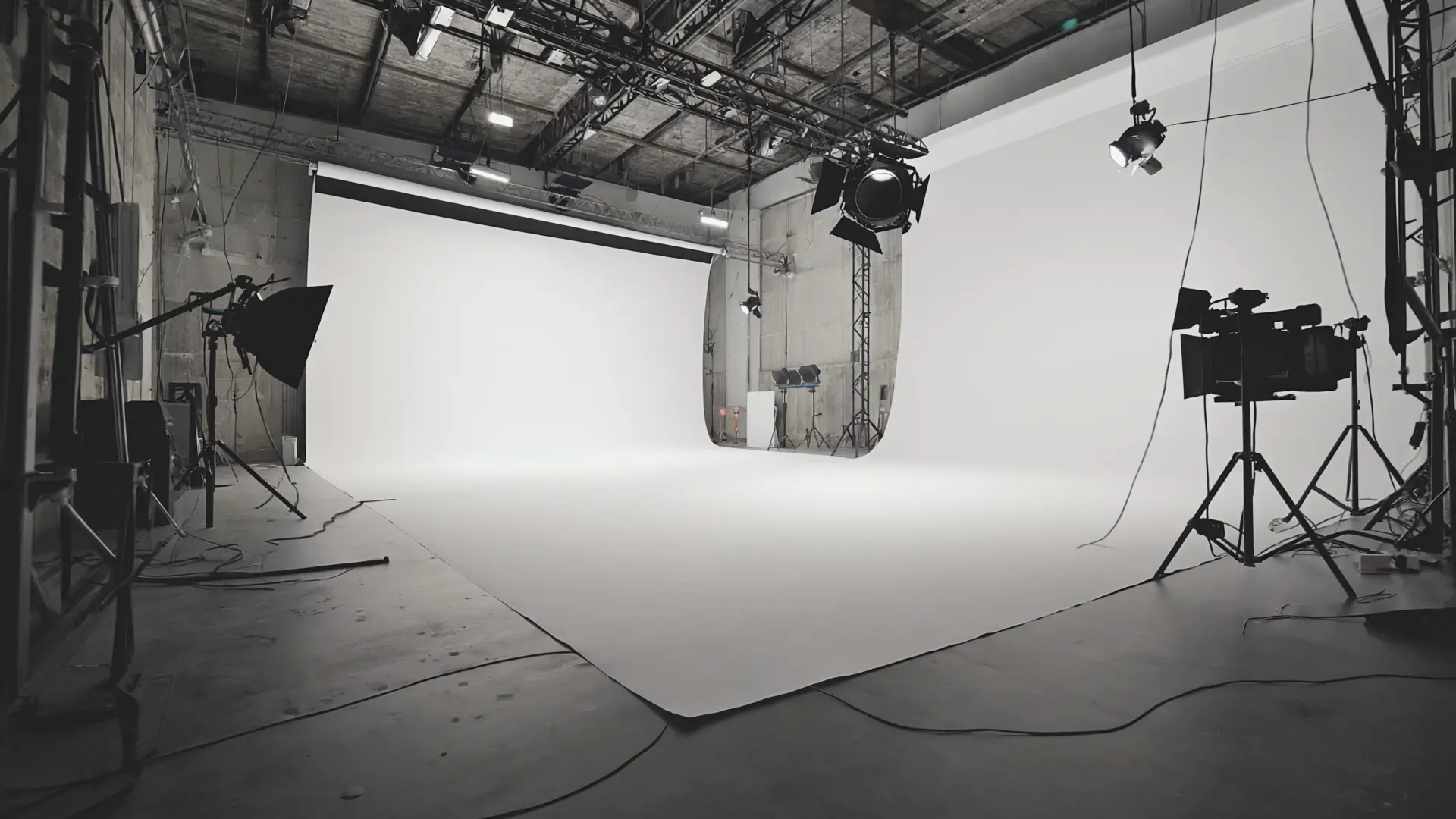

One of the most noticeable changes in today’s entertainment landscape is the growing skepticism around massive film budgets.

For years, productions costing $150–200 million became the norm, even when the story’s scope didn’t always justify the expense. I never fully understood why some projects needed to cost that much. In many cases, there were clear opportunities to control spending, simplify production, or solve problems creatively instead of financially.

I’ve long felt that when a film limits its budget, it often forces filmmakers to make more creative decisions. Constraints demand focus. They push directors and writers to think carefully about what truly serves the story rather than defaulting to spectacle.

Throwing money at a project doesn’t necessarily make a story better — it may look impressive, but spectacle alone rarely strengthens storytelling.

Throwing money at a project doesn’t necessarily make a story stronger. It can make a film visually stunning—sometimes breathtaking—but spectacle alone rarely improves character, pacing, or emotional impact. A movie can be beautiful to look at and still feel hollow.

This broader reassessment is visible across the industry. Disney CEO Bob Iger has publicly acknowledged that the company produced too much content in recent years and is now pulling back on volume to refocus on quality, particularly within its major franchises, a shift reported by Gamespot and echoed in subsequent coverage.

The Entertainment Industry in 2026 and the End of “Peak TV”

Alongside shrinking film budgets, television and streaming output has also contracted.

At the height of the streaming boom, U.S. original scripted series output reached record levels. That expansion has since reversed. FX’s annual count of scripted television series, long used as a benchmark for the industry, showed a clear decline from the peak years, a trend reported by Variety and reinforced by Reuters.

Oversaturation made it harder for shows to break through, inflated marketing costs, and stretched creative talent thin. Platforms eventually recognized that flooding the market did not translate into lasting audience engagement or sustainable economics.

Netflix executives have repeatedly framed their current strategy as keeping content spending disciplined relative to revenue growth in order to improve margins, language that appears consistently in earnings coverage and analyst reporting, including summaries published by Reuters.

AI as a Production Tool, Not a Creative Replacement

Artificial intelligence has become part of everyday entertainment workflows—but in quieter, more practical ways than early fears suggested.

In 2026, AI supports scheduling, budgeting, script analysis, previs, localization, and marketing optimization. It is being treated less as a creative replacement and more as an efficiency layer, helping teams reduce friction and make faster, better-informed decisions.

What AI has replaced is inefficiency, not imagination. Creative judgment, emotional nuance, and narrative voice remain human-driven. AI now functions as infrastructure, similar to CGI or digital editing, improving workflows without redefining authorship.

Warner Bros., HBO, and HBO Max in a Restructuring Era

Financial discipline is also reshaping the corporate structure of major entertainment companies.

Warner Bros. Discovery has spent the past several years restructuring its film, television, and streaming businesses as the economics of cable and streaming continue to diverge. The company’s plans to separate its cable networks from its studios and streaming operations, including HBO and Max, reflect trends also discussed in earlier industry rebuilding analysis.

Reuters has also reported on broader consolidation discussions involving Warner Bros. Discovery and other major players, highlighting how cost pressures and investor expectations are driving the industry toward fewer, more focused business models rather than endless expansion.

The Shift Toward Participatory and Immersive Entertainment

Another defining trend in the entertainment industry in 2026 is the move away from purely passive viewing experiences.

Audiences increasingly want interaction, immersion, and a sense of participation. Gamified storytelling, virtual concerts, live digital events, and hybrid entertainment formats are gaining traction, particularly among younger audiences. This mirrors themes explored in the evolving creator economy.

Entertainment is evolving into something audiences don’t just watch—but actively engage with.

A Globalized Production Model Replaces a Hollywood-Only System

Production in 2026 is no longer confined to a single geographic center.

Studios increasingly rely on global production hubs across Eastern Europe, South Korea, India, Canada, and Latin America, driven by tax incentives, skilled crews, and cost efficiencies. Advances in virtual production and remote collaboration have made high-end global workflows more viable than ever.

What This Snapshot of the Entertainment Industry in 2026 Tells Us

This moment in the entertainment industry is not defined by decline—it is defined by correction.

The excesses of the 2010s created unsustainable habits. What we are seeing in the entertainment industry in 2026 is a reassessment of how much content is produced, how much money is spent, and how success is measured.